Air travel tickets often include surprisingly large amounts described as "tax." In one round trip New York-Paris ticket we quoted in January 2012, the fare was listed as $230 while "tax" was listed as $598.14 -- fully 72% of the listed total. If government taxes were actually as large as Air France claims, many passengers might want to complain to responsible politicians and regulators. And passengers might have a different view of cramped seating, unpalatable food, or other service shortfalls on a $230 ticket versus a $828.14 ticket. But in fact, specifically contrary to Air France's characterization of $598.14 as "tax," the majority of the "tax" was not charged by any government, airport, or similar authority, and rather was retained by Air France to defray its ordinary operating expenses.

This page presents a variety of examples in which airlines have mischaracterized various surcharges as "tax" and otherwise failed to satisfy applicable price advertising regulation. We present proof in both screenshots and recorded telephone calls, preserving clear records of carriers' misrepresentations.

Airlines have long been subject to a prohibition on unfair and deceptive practices and unfair methods of competition (49 U.S.C. § 41712). Historically, Department of Transportation regulations permitted airlines to state government-imposed taxes and fees separately from base fares so long as such taxes and fees were levied by a government entity, were collected on a per-passenger basis (not as a percentage of base fare), and their existence was clearly indicated at the first point in the advertisement where a fare was presented. Carriers were never permitted to separate carrier-imposed surcharges from base fare.

Beginning on January 26, 2012, new DOT rules (14 CFR 399.84(a)) require that the first price advertised for air travel must include all taxes, government-imposed fees, and mandatory airline- and ticket agent-imposed fees. An advertised price may include an itemization of taxes, government-imposed fees, and carrier-imposed fees, but these descriptions cannot be false or misleading. If a carrier elects to separate carrier-imposed fees from the base fare, the DOT requires that such fees must accurately represent the actual cost of the item for which the cost is accessed, and the carrier must substantiate the fee with a brief description. (The DOT also requires that the method of calculation be presented to passengers. Details.)

This article presents violations of applicable DOT rules, including carrier-imposed surcharges mischaracterized as "tax" as well as carriers' failures to defend the calculation of the fuel surcharge amounts.

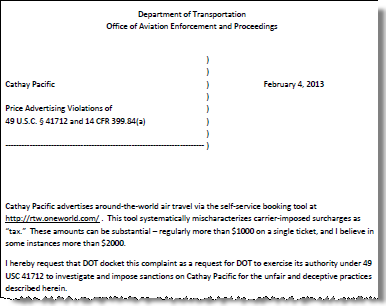

Reviewing the examples above, it is striking to see exceptionally large fuel surcharges -- regularly as much as two thirds of airfare. (For example, in the Air France example above: $476 of fuel surcharge versus $230 of base fare, putting fuel surcharge at 67% of the total airfare.) Could 67% of airfare truly be "fuel surcharge"? The DOT instructs:

When a cost component is described as a fuel surcharge, for example, that amount must actually reflect a reasonable estimate of the per-passenger fuel costs incurred by the carrier above some baseline calculated based on such factors as the length of the trip, varying costs of fuel, and number of flight segments involved.

The DOT requires that this estimate be substantiated in calculations presented to consumers:

For example, descriptions such as the following would be acceptable: 'Fare includes a fuel surcharge. On average our passengers paid $xx.xx more for fuel during 2011 in their ticket price than they did in 2000;' or 'Fares include a charge for fuel. On average in 2011 our passengers paid $xx.xx for fuel as a part of their ticket price.' Of course, such assertions must be based on the carrier's actual paid enplanements and fuel expenditures.

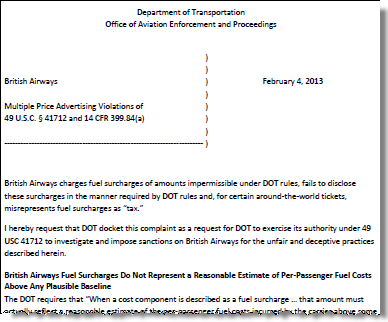

We have never seen a single itemization, presented within a price advertisement or online purchase process, that even approaches these requirements. In contrast, we see fuel surcharges with no apparent link to increased fuel price above a baseline. For example, in June 2012 we used the British Airways web site to quote an ordinary paid round-trip coach ticket for BOS-LHR in coach at $668 plus government taxes of $213.52. In contrast, when we asked to redeem BA "OnBusiness" loyalty points for the same flights on the same dates, the OnBusiness redemption tool noted the required points plus $438 of British Airways fuel surcharge and government taxes of $213.52. It is not plausible that $438/$668=70% of total airfare is fuel cost above a baseline. Indeed, during the prior twelve-month period, the U.S. Bureau of Transportation reports that airline fuel cost for international flights increased by just 0.19%. BA's high fees, versus stable costs, indicate that the British Airways “fuel surcharge” does not reflect a reasonable estimate of per-passenger fuel costs above a baseline.

Indeed, the Department of Transportation has repeatedly expressed skepticism as to carriers' large fuel surcharges. For example, in its October 2012 enforcement action against British Airways, the DOT specifically noted that itemized charges such as fuel surcharges "may be labeled surcharges only if the amount quoted is an accurate reflection of the relevant cost component, such as the added cost of fuel over some baseline." In its November 2012 enforcement action against Air France, the DOT reaffirmed that itemized charge must "accurately reflects the cost of the item covered by the charge." DOT's order specifically notes that the DOT has not evaluated or approved the large Air France fuel surcharge; the DOT remarks that the requirement of accurate reflection of cost is "not addressed in this order."

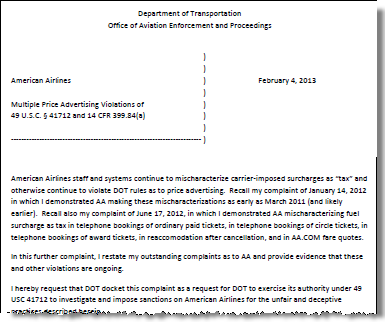

To date the DOT has brought no cases as to fuel surcharges amounts that are impermissible under this standard. To that end, on February 4, 2013 Edelman filed a complaint as to the large fuel surcharges currently imposed by British Airways. Edelman shows that BA's fuel surcharge is often more than 70% of the total airfare of an ordinary paid ticket, and Edelman examines fuel costs and fuel consumption to demonstrate that BA's fuel surcharge revenue is likely to exceed BA's fuel expense. In short, BA's fuel surcharges are an implausible estimate and impermissibly poor estimate of BA's fuel cost above a baseline.

In our view, the required resolution is clear: Any airline has charged a fuel surcharge that is impermissible under law should refund the unlawful amounts to affected consumers. Having claimed that "tax" existed in specified amounts, when in fact there were never any actual taxes of those amounts, carriers should return those funds to any consumers who so request. So too for fuel surcharges collected in amounts beyond what is permitted by law.

Similar refunds were provided after it was revealed that airlines had engaged in price fixing for both passenger and cargo air transport. In investigations beginning in 2006, the United States Department of Justice (DOJ) and UK Office of Fair Trading found that British Airways and Virgin Atlantic had colluded in fixing passenger fuel surcharges. The DOJ also found that Korean Air Lines had colluded with Asiana Airlines to fix passenger fuel charges and fares from the United States to Korea. In total the DOJ collected fines of over $1.8 billion (including from 17 other airlines also found to be participating), the largest total amount of criminal fines ever imposed in a DOJ Antitrust Division investigation. In addition, four airline executives were sentenced to a total of 28 months in jail. Crucially, subsequent litigation granted passengers at least partial refunds, with authorized amounts in the BA case totaling up to $59 million (for US passengers) and £73 million (for UK passengers), as well as $11 million cash plus $10 million of vouchers in the Asiana matter. As participants in the DOJ's Corporate Leniency Program, Virgin Atlantic and Lufthansa also agreed to pay restitution to the US victims of their price-fixing.

To our surprise, airlines have attempted to conceal their misbehavior by affirmatively misrepresenting what fees they charged and how those fees were disclosed to consumers. For example, in December 2011 we used the AA.COM "Contact Us" feature to ask AA Customer Relations staff about large charges listed as "tax" on recent award travel. In an email reply, a representative references "a $309.60 fuel tax collection by British Airways," "a $251 fuel tax collection by British Airways," and "a $502 fuel tax collection by British Airways." In fact all of these amounts were carrier-imposed surcharges, not "tax." Similarly, in correspondence of December 2011, we asked Qatar Airlines US Customer Relations staff about an unexpectedly large amount in the "tax" section of the electronic ticket receipt. The agent replied by stating that the "tax" included "SGD66.40 YQ for fuel surcharge". When we informed the agent that fuel surcharge is not a "tax", the agent made the unlawful statement that "Our YQ (Fuel Surcharge) labelled as tax is correct. It is a common practice with many Airlines and our program." These false statements serve to hinder passenger efforts to uncover violations of applicable law.

Our subsequent correspondence with airlines' senior managers reveals a similar refusal to refund fuel surcharges even when there is no serious dispute of the airline's unlawful characterization of such surcharges. For example, our March 25, 2012 letter to Gary Kennedy, General Counsel of American Airlines, presented personal first-hand experience of numerous AA agents mischaracterizing fuel surcharges as "tax", including specific dates and specific amounts along with quotes from recorded phone calls with AA representatives. In a reply of June 26, 2012, AA Associate General Counsel Carl Nelson ignored this proof and refused to provide a refund. Our reply of June 29, 2012 rebuts the limited analysis provided by Mr. Nelson, but to date we have received neither a reply nor a refund of the amounts charged unlawfully.

Edelman filed numerous complaints with the US Department of Transportation. Click for an index of complaints, factual allegations, briefing, and DOT decisions.

See also Edelman's June 2014 filing with DOT as to the importance of a tariff to assure accurate pricing and other consumer benefits.

Even when fuel surcharges are properly disclosed as such, they have given rise to considerable dispute. For one, carriers sometimes colluded in setting surcharges: A single regional or zone surcharge is a natural candidate for collusion, in that a carrier typically implements a single surcharge amount for all flights in a given region or distance, making it easy for carriers to check others' surcharges, assure compliance with a collusive agreement, and flag any violations. (In contrast, carriers would be more likely to struggle to coordinate myriad route-specific fares which vary based on distance, advance purchase, penalties, and other restrictions.) Litigation revealed that carriers explicitly discussed fuel surcharges, and fuel surcharges increased sharply during these discussions. For example, according to the DOJ and the U.K. Office Of Fair Trading, British Airways and Virgin Atlantic discussed "fuel surcharges" at least six times between August 2004 and January 2006, during which time fuel surcharges rose from £5 and $10 to £60 and $110 on each round-trip ticket.

Surcharges also harm customers who have negotiated special discounts, especially corporate customers. Consider a customer who negotiated a percentage discount from ordinary fares. When an airline adds a fuel surcharge, it will often argue that such a customer must pay the entire surcharge, notwithstanding the negotiated discount. For example, if base airfare is $1000 and the customer has negotiated a 40% discount on airfare, the customer would expect to pay (1-0.4)*$1000=$600 (plus actual government-imposed taxes). But if the carrier recharacterizes the fare as $800 plus a $200 surcharge, the carrier would likely require the customer to pay (1-0.4)*$800 + $200 = $680 -- an $80 increase. This price increase would arrive months after the contract was negotiated -- quite a surprise to most customers. Contracting procedures exacerbate the problem: A customer would expend significant effort to rebid the contract, in all likelihood out of sequence relative to the customer's standard procurement process. And if the contract purported to require the customer to book certain travel on a favored carrier for a specified period ("80% of transatlantic travel on carrier x") or in a speciifed amount ("customer will spend $x on carrier y during calendar year 2012"), the customer would typically struggle to determine whether the surcharge is grounds for exiting the contract without penalty.

For travel agents, fuel surcharges threaten to reduce the base ticket prices on which commissions and other payments are calculated. While some airlines have cut or eliminated travel agent commissionsm, others continue to pay travel agents, and fees are typically proportional to the total price of tickets sold. By excluding fuel surcharges from these calculations but keeping percentages unchanged, airlines can reduce commission payments to travel agents. In 2006, a class action of travel agents sued Qantas for exactly this, and a 2010 decision in Australia Federal Court held that Qantas is obliged to pay "commission or other remuneration for the sale of international air passenger transportation." Similarly, in December 2012, a London court found that Pakistan International Airlines (PIA) had unlawfully failed to pay commissions to travel agents on the value of passengers' fuel surcharges. Similar litigation is ongoing against Air New Zealand, British Airways, Cathay Pacific, Singapore Airlines, and Malaysian Airlines.

Posted: February 6, 2013

Last updated: February 27, 2023

Sign up for notification of major updates and related work.