I’ve always had high hopes for affiliate marketing — a great way for small web sites to cover their costs and make a reasonable return, by promoting well-known merchants relevant to their visitors. I stand by this optimism, in general. But after several years of watching this space, my expectations have fallen significantly. I’ve seen countless examples of “rogue” affiliates cheating their “partner” merchants. And I’ve seen plenty of underhanded practices from merchants too.

Popular wisdom says most “rogue” affiliates are small. The big guys have too much to lose by getting caught. So we can trust them to behave. Or can we?

Intro to Affiliate Marketing and Small-Time Rule Breakers

In principle there’s nothing unique about affiliate marketing: As in other marketing channels, merchants pay third parties to promote their products. And as in other marketing channels, sometimes this advertising goes terribly wrong — showing merchants’ ads in ways that don’t reflect well on the merchant or the ad channel, cheating merchants by claiming payments not fairly earned, and siphoning payments from other ad channels.

What’s notable about affiliates is the relative prevalence of bad practices. Through affiliate networks, merchants sign up to advertise with hundreds of small companies (and individuals) they don’t really know and haven’t reasonably investigated. Worse, when an affiliate gets caught breaking the rules, the affiliate often just signs up under a new name: Having earned little reputation, the affiliate has little to lose, so there’s little penalty for starting fresh under a new name. With such limited accountability, enforcement is tougher than in other channels. Hence my sense that there are more bad actors in affiliate marketing than in other kinds of marketing.

I show examples of these problems in my September piece on affiliates funding spyware and simultaneously defrauding merchants. See also my Affiliate Summit slides showing new examples of similar practices.

Of course not all affiliate fraud uses spyware. There’s affiliate cookie-stuffing, whereby affiliates claim commissions without users actually clicking through a link to merchants’ sites. (This violates networks’ rules, which say a merchant only has to pay a commission if a user clicks a link.) See also my index of additional affiliate research and testing.

In calling these rule-breakers “small,” I don’t mean to say they don’t make real money by cheating merchants. Quite the contrary! But these “small” affiliates earn fees without developing brand names for themselves. They’re “small” in the sense of appearing and disappearing willy-nilly, without anyone much caring or, in many cases, even noticing.

Big Affiliates Breaking the Rules: CoolSavings and MyPoints

With slim to nonexistent reputations, small affiliates are often tempted to flout the rules. But major affiliates also compromise ethics in order to increase profits.

Notorious among affiliates gone bad is ShopAtHomeSelect, whose software has been widely installed without consent and has been widely observed to “force clicks” without an affirmative end user action. These practices got SAHS kicked out of CJ in fall 2005. But oddly SAHS remains in LinkShare.

Turning to fresh research: Consider well-known affiliates CoolSavings and MyPoints. CoolSavings is a $16.7+ million company, featured in various LinkShare promotional materials, even touted in Wall Street Journal coverage of affiliate marketing. MyPoints is featured in a CJ case study, and LinkShare lists MyPoints with just five other premium “partners” on a special page. So CoolSavings and MyPoints are big, well-respected affiliates. If they don’t follow the rules, no one will.

As it turns out, CoolSavings and MyPoints are widely violating applicable rules. Despite clear prohibitions from affiliate networks, both CoolSavings and MyPoints recently began using “adware” (“spyware,” most users would say) to recruit new users, at the expense of their targeted “partner” merchants. See screenshots below, showing CoolSavings and MyPoints receiving traffic from Direct Revenue. When users visit targeted merchants, Direct Revenue shows CoolSavings or MyPoints pop-ups, which encourage users to register and ultimately to click through to merchants’ sites. Then merchants end up paying CoolSavings or MyPoints for users they already had — expenses they need not have paid, but for CoolSavings’ and MyPoints’ intervention.

|

|

|

| CoolSavings Targeting Buy.Com via Direct Revenue (January 12, 2006) |

MyPoints Targeting a CJ Merchant via Direct Revenue (January 2, 2006) |

CoolSavings and MyPoints’ ads violate applicable affiliate network rules. Commission Junction prohibits affiliates from buying media from “ad services that download and install software on an end user’s computer” — so traffic from Direct Revenue is clearly off-limits. But that’s not the only rule these pop-ups violate. Recall CJ’s rule against “in any manner … modif[ying]” others’ sites. And LinkShare forbids (PDF) “alter[ing] in any manner the Web user’s … view … of … any network affiliate webpage” (rule 1.(a)(i)).

In my view, these Direct Revenue-delivered pop-ups are serious offenses against the targeted merchants. CoolSavings’ and MyPoints’ pop-ups appear as users browse affiliate merchants’ web sites. For example, a CoolSavings pop-up (shown above, at left) appeared as I browsed Buy.com, a CoolSavings partner: Buy.com pays CoolSavings for sending it customers. But despite this alliance and despite applicable affiliate network rules, CoolSavings still uses use Direct Revenue to grab Buy.com customers.

When MyPoints performs similar targeting of its merchant partners, MyPoints explicitly attempts to capitalize on its partners’ goodwill. In the areas blocked out in green (in the right screenshot above), MyPoints specifically names the company a user was visiting before MyPoints interrupted. These references give MyPoints’ ads a further appearance of legitimacy. But the references simultaneously tarnish MyPoints’ partners’ good names — by putting their names into Direct Revenue pop-ups.

Earlier this month, I brought MyPoints’ use of Direct Revenue to the attention of a targeted CJ merchant. Since that report, I haven’t seen many MyPoints pop-ups appearing through Direct Revenue. But affiliates ought to comply with applicable rules from the get-go, without me first identifying or reporting infractions. Merchants should demand no less.

I will update this piece with any material statements I receive from merchants, networks, or CoolSavings or MyPoints. I will be particularly interested in penalties, if any, assessed against these affiliates for their violations of networks’ rules.

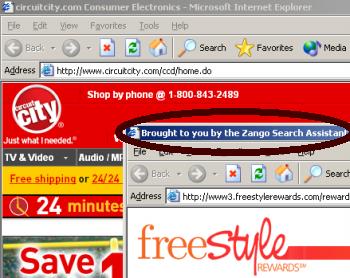

Update (January 31): I have received no response from CoolSavings, MyPoints, or any affiliate network. But despite my public documentation of CoolSavings’s practices, CoolSavings’s “adware”-delivered ads continue. See screenshot below, showing a CoolSavings FreeStyleRewards popup delivered by 180solutions (“Zango”), as users browse Circuit City’s web site.

CoolSavings’ FreeStyleRewards Continues to Target Circuitcity.com via 180solutions (January 28, 2006)

CoolSavings’ FreeStyleRewards Continues to Target Circuitcity.com via 180solutions (January 28, 2006)

FreeStyleRewards’ merchant list (registration required) confirms that Circuit City is a FreeStyleRewards advertiser. So not only is CoolSavings FreeStyleRewards buying adware-delivered traffic (in specific violation of an applicable Commission Junction rule), but FreeStyleRewards is also targeting its business partner’s traffic.

CoolSavings FreeStyleRewards cannot claim ignorance of its traffic sources. For one, these practices have been publicly-documented for two weeks, since my initial January 16 article. Furthermore, 180 sends traffic to a FreeStyleRewards URL that specifically confirms CoolSavings FreeStyleRewards’s knowledge of the traffic’s origin: http://www.freestylerewards.com?ref=metricsdirect&bn=www_circuitcity_com&bl=lp-ce . Notice the highlighted reference to MetricsDirect, the advertising sales division of 180solutions.

Update (February 17): I have received a statement from MyPoints. I quote it here in its entirety:

“MyPoints is a leader in permission-based marketing and is firmly committed to marketing ourselves through channels and with products that respect the privacy and experience of consumers and deepen our productive relationships with our advertisers.

From November 2005 through the middle of January 2006, MyPoints ran a small-scale campaign with an “adware” firm.

When we became aware that the campaign might be in conflict with the best interests of our advertisers, we immediately pulled the advertisements and terminated our relationship with the company.

MyPoints will continue to be extra diligent with regard to selection of acquisition partners. We maintain extremely strong relationships with the affiliate networks and their merchant partners. MyPoints continues to be a leader in opt-in marketing and sets the highest bar possible with respect to privacy, permission and choice.”

CoolSavings Continues to Target Its Merchants via Hotbar

CoolSavings Continues to Target Its Merchants via Hotbar

(February 19, 2006)

Update (February 19): I have continued to observe CoolSavings ads appearing through advertising software, still in violation of applicable CJ rules and stil targeting CoolSavings merchants. See screenshot at right, observed last week on a PC running Hotbar, as I browsed the web site of a CoolSavings merchant.