Complaint. Answer. Docket and public comments.

Status: Consent order. $10,000 penalty.

Summary: mischaracterizing surcharges as “tax”

Complaint. Answer. Docket and public comments.

Status: Consent order. $10,000 penalty.

Summary: mischaracterizing surcharges as “tax”

Complaint. Answer and supplemental submission. Docket and public comments.

Status: Dismissal.

Summary: mischaracterizing surcharges as “tax”

Complaint. Answer. Edelman Reply. Air Europa Motion to Strike. Docket and public comments.

Status: Consent order. $100,000 penalty.

Summary: mischaracterizing surcharges as “tax”

Complaint. Answer. Docket and public comments.

Status: Consent order. $65,000 penalty. (Consolidated with complaints from two other passengers)

Summary: price advertising violations including mischaracterizing surcharges as “tax”

Affiliate programs vary dramatically in their incidence of fraud. In some merchants’ affiliate programs, rogue affiliates fill the ranks of high-earners. Yet other similarly-sized merchants have little or no fraud. Why the difference?

In Information and Incentives in Online Affiliate Marketing, Wesley Brandi and I examine the impact of varying merchant management decisions. Some merchants hire specialist outside advisors (“outsourced program managers” or OPM’s) to set and enforce program rules. Others ask affiliate network staff to make these decisions. Still others handle these tasks internally.

A merchant’s choice of management structure has significant implications for both the information available to decision-makers and the incentives that motivate those decision-makers. Outside advisors tend to have better information: An OPM sees problems and trends across its many clients. A network is even better positioned — enjoying direct access to log files, custom reports, and problems reported by all merchants in the network. That said, outside advisors usually suffer clear incentive problems. Most notably, networks are usually paid in proportion to a merchant’s affiliate channel spending, so networks have a significant incentive to encourage merchants to accept even undesirable affiliates. In contrast, incentives for merchants’ staff are typically more closely aligned with the merchant’s objectives. For example, many in-house affiliate managers have stock, options, or bonus that depend on company profitability. And working in a company builds intrinsic motivation and loyalty. In short, there are some reasons to think outsourced specialists will yield superior results, but other reasons to favor in-house staff.

To separate these effects, we used crawlers to examine affiliate fraud at what we believe to be unprecedented scope. Our crawlers ran more than 2 million page-loads on a variety of computers and virtual computers, examining the relative susceptibility of all CJ, LinkShare, and Google Affiliate Network merchants (as of spring 2012) to adware, cookie-stuffing, typosquatting, and loyalty apps.

We found outside advisors best able to find “clear fraud” plainly prohibited by network rules, specifically adware and cookie-stuffing. But in-house staff did better at avoiding “grey area” practices such as typosquatting — schemes less plainly prohibited by network rules, yet still contrary to merchants’ interests. On balance, there are good reasons to favor each management approach. Our advice: A merchant choosing outsourced management should be sure to insist on borderline decisions always taken with the merchant’s interests at heart. A merchant managing its programs in-house should be careful to avoid known cheaters that a savvy specialist would more often exclude.

Our results clearly reveal that networks take actions that are less than optimal for merchants. It’s tempting to attribute this shortfall to malicious intent by networks, but the same outcome could result from networks simply putting their own interests first. Consider a network that receives undisputed proof that a given affiliate is cheating a given merchant. Should the network eject that affiliate from the entire network (and all affiliated merchants), or only from that single merchant’s program? The former helps dozens or hundreds of merchants, but with corresponding reduction to network revenues. No wonder many networks chose the latter. Similarly, when networks decide how much to invest in network quality — engineers, analysts, crawlers, and the like — their incentive to improve quality is tempered by both direct cost and foregone revenue.

Incidental to our analysis of management structure, we gathered significant data about the scope of affiliate fraud more generally. Some differences are stark: For example, Table 4 reports Google Affiliate Network merchants suffering, on average, less than half as much adware and cookie-stuffing as LinkShare merchants. I’ve been critical of Google on numerous issues. But when it comes to affiliate quality, GAN was impressive, and GAN’s high standards show clearly in our large-sample data. Note that our analysis precedes Google’s April 2013 announcement of GAN’s shutdown.

Our full analysis is under review by an academic journal.

(update: published as Edelman, Benjamin, and Wesley Brandi. “Risk, Information, and Incentives in Online Affiliate Marketing.” Journal of Marketing Research (JMR) 52, no. 1 (February 2015): 1-12. (Lead Article.)

Ashlagi, Itai, Benjamin Edelman, and Hoan Soo Lee. “Competing Ad Auctions.” Harvard Business School Working Paper, No. 10-055, January 2010. (Revised May 2010, February 2011, September 2013.)

We present a two-stage model of competing ad auctions. Search engines attract users via Cournot-style competition. Meanwhile, each advertiser must pay a participation cost to use each ad platform, and advertiser entry strategies are derived using symmetric Bayes-Nash equilibrium that lead to the VCG outcome of the ad auctions. Consistent with our model of participation costs, we find empirical evidence that multi-homing advertisers are larger than single-homing advertisers. We then link our model to search engine market conditions: We derive comparative statics on consumer choice parameters, presenting relationships between market share, quality, and user welfare. We also analyze the prospect of joining auctions to mitigate participation costs, and we characterize when such joins do and do not increase welfare.

Ad injectors insert ads into others’ sites, without permission from those sites and without payment to those sites. In this article, we review the basic operation of ad injectors, then examine the ad networks, exchanges, and other intermediaries that broker the placement of advertising through injectors.

We also report which advertisers most often advertise through injectors. Whether through complexity, inattention, or indifference, these advertisers’ expenditures are ultimately the sole revenue source for injectors.

Coles, Peter, and Benjamin Edelman. “Mobilizing an Online Business.” Harvard Business School Background Note 913-061, June 2013. (educator access at HBP. request a courtesy copy.)

Entrepreneurs starting online businesses often need to mobilize multiple sets of users or customers, each of whom hesitates to participate unless others join also. This case presents several challenges with similar structure.

Supplements:

Mobilizing an Online Business slide supplement – PowerPoint Supplement (HBP 913702)

Mobilizing an Online Business slide supplement (widescreen) – PowerPoint Supplement (HBP 914053)

Teaching Materials:

Mobilizing an Online Business – Teaching Note (HBP 913062)

The European Commission last month posted a restatement of its concerns at certain Google practices as well as Google’s proposed commitments. This week I filed two comments, including one with Zhenyu Lai, critiquing Google’s proposal. They are available here:

Comments on AT.39740 (Edelman and Lai) as to Google’s exclusive use of screen space to promote its own specialized services, and as to an alternative remedy to preserve competition and user choice in the area of specialized search services.

Comments on AT.39740 (Edelman) as to the failure of Google’s proposed commitments to undo the harm of Google’s past violations, and alternative remedies preserve competition in the area of specialized search services, taking data from publishers, providing advertising services to publishers, and allowing advertisers to use multiple ad platforms.

As to Google’s decision to favor its own specialized search services, Zhenyu and I question whether Google’s proposed commitments would effectively preserve competition. In our recent measurement of the effects of Google Flight Search, we found that Google’s large Flight Search “onebox” displays sharply reduced traffic to other online travel agencies as well as driving up the proportion of clicks to AdWords advertising. Google proposes to display a few small “Rival Links” to competitors, but these links would be placed and formatted in ways that make them unlikely to attract users’ attention or facilitate competitive markets.

As to Google’s decision to favor its own specialized search services, Zhenyu and I question whether Google’s proposed commitments would effectively preserve competition. In our recent measurement of the effects of Google Flight Search, we found that Google’s large Flight Search “onebox” displays sharply reduced traffic to other online travel agencies as well as driving up the proportion of clicks to AdWords advertising. Google proposes to display a few small “Rival Links” to competitors, but these links would be placed and formatted in ways that make them unlikely to attract users’ attention or facilitate competitive markets.

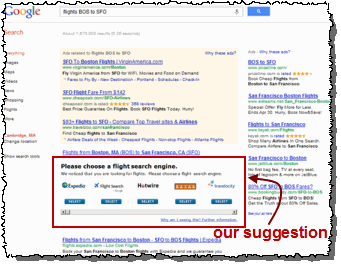

Instead, we suggest a “ballot box” in which users can choose their preferred specialized search services in any area where Google offers and favors its own specialized search services. For example, the first time a user runs a hotel search or flight search, the user would be presented with a menu of options — reminiscent of the “browser ballot box” a user sees when first booting Windows in Europe. This approach is entirely feasible: Facebook has long merged content from myriad independent developers; numerous developers quickly built browser add-ons to disable Google Search Plus Your World when they found its initial results unhelpful; and the G++ for Google Plus browser add-on integrates other social networks with G+ even though Google declines to provide such integration. Indeed, search engine guru Danny Sullivan in September 2011 suggested that Google “let[] people choose their shopping, local, etc one box provider?”, echoing my February 2011 call for interchangeable components for competing specialized search services. In our comment, Zhenyu and I explore a proposed implementation of this concept.

As to the Commission’s concerns more generally, my comment addresses Google’s failure to undo the harm resulting from Google’s past violations. For each of the Commission’s concerns, I present alternative remedies focused on protecting competition and affirmatively undoing the harm from Google’s past violations. I also flag the need for tough penalties to deter further violations by Google and others.

Reuters yesterday reported that the Commission is likely to require further concessions from Google, including improved remedies. Comments to the Commission are due by June 27.

Edelman, Benjamin. “Comments on Commitments in AT.39740 — Google.” May 2013.

I evaluate the remedies in Google’s proposed Commitments, and I propose additional remedies to more fully address the Commission’s concerns.