Edelman, Benjamin. “Comments on Commitments in AT.39740 — Google.” May 2013.

I evaluate the remedies in Google’s proposed Commitments, and I propose additional remedies to more fully address the Commission’s concerns.

Competition and antitrust

Edelman, Benjamin. “Comments on Commitments in AT.39740 — Google.” May 2013.

I evaluate the remedies in Google’s proposed Commitments, and I propose additional remedies to more fully address the Commission’s concerns.

Edelman, Benjamin, and Zhenyu Lai. “Comments on Commitments in AT.39740 — Google.” May 2013.

We evaluate Google’s proposed Commitments in light of our research on the effects of Google Flight Search on traffic to competing online travel agencies.

Google often shows “OneBox” search results promoting its own services. These results have prompted antitrust scrutiny: Google awards these preferred placements exclusively to Google’s own services, such as Google Flight Search and Google Maps, but never to competing services such as Kayak or Mapquest. Moreover, Google presents OneBox with special format, including distinctive layouts, extra images, and even in-page interactivity — benefits not available to ordinary listings for other sites. Regulators and competitors sense that these exclusive practices can undermine competition and innovation by denying traffic to would-be competitors. But how large is the effect? How much does Google’s exclusive OneBox placement impact search engine traffic to adjacent online markets?

In a working paper, Zhenyu Lai and I measure the impact of OneBox by using a quasi-experiment before and after the introduction of Google Flight Search. Using a third-party data service, we compare user behavior on searches across thousands of search queries like “cheap flights from sfo to san ” (which displayed a OneBox for Google Flight Search), and similar search queries like “cheaper flights from sfo to san” (emphasis added) (which did not display OneBox). We find that Google’s display of Flight Search in an exclusive OneBox decreased user click-through rates on unpaid search results by 65 percent, and increased user click-through rates on paid advertising links by 85 percent. This effect was disproportionately evident among online travel agencies that were popular destinations for affected search queries.

Our draft provides detailed empirical results as well as a model of how a search engine’s incentives to divert search depend on consumers’ perceptions of the difference between non-paid and paid placements.

Exclusive Preferential Placement as Search Diversion: Evidence from Flight Search

(update: published as Edelman, Benjamin, and Zhenyu Lai. “Design of Search Engine Services: Channel Interdependence in Search Engine Results.” Journal of Marketing Research (JMR) 53, no. 6 (December 2016): 881-900.)

Last week the FTC closed its 21-month investigation of Google after Google made several small concessions, among them dropping certain restrictions on use of Google’s AdWords API — rules that previously limited how advertisers and tool-makers may copy advertisers’ own data from Google’s servers. Removing the restrictions is a step forward for advertisers and for competition. But the FTC could and should have demanded more from Google in order to address the harm resulting from seven years of these restrictions.

I first flagged Google’s AdWords API restrictions in my June 2008 senate testimony and in greater detail in PPC Platform Competition and Google’s “May Not Copy” Restriction. In short, the restrictions prohibited making and sharing tools to quickly copy and synchronize ad campaigns across multiple ad platforms — effectively compelling small to midsized advertisers to use Google only, for lack of tools to manage their campaigns on multiple platforms. Google enforces this prohibition with a system of tool passwords and audits — letting Google swiftly and completely disable any tool that Google deems impermissible. Indeed, any tool-maker found offering a noncompliant tool would immediately lose all access to Google’s AdWords API, as to all of its tool-using subscribers, a devastating blow that kept tool-makers under Google’s thumb.

As I pointed out, these AdWords API restrictions let Google charge prices higher than competing platforms: Thanks to these restrictions, a small to midsized advertiser would struggle to buy some placements from Yahoo or Microsoft, even if those vendors offered lower prices. Higher advertising costs directly harm advertisers, and higher prices get passed to consumers (according to the relative elasticity of supply and demand). I also pointed out harms to others in the advertising ecosystem: Competing ad platforms struggle to attract advertisers, hence showing less relevant advertising (discouraging users from clicking ads) and enjoying less auction pressure to push prices upward. Meanwhile, I noted, the AdWords API restrictions give Google that much more leverage in its negotiations with publishers: by weakening other ad platforms’ monetization, Google can more easily win deals for publishers’ inventory, granting publishers lesser compensation for the content they post.

Strikingly, Google has never seriously defended the AdWords API restrictions. In June 2008, Doug Raymond, Product Manager for AdWords API, argued that advertisers are free to export their data in other ways, e.g. as a CSV text file. But that far-inferior manual export is ad-hoc, time-consuming, and error-prone — a poor fit for high-priced online advertising. Indeed, this manual approach is a sharp contrast from a modern automation API, and a far cry from what Google offers in other contexts.

By all indications, competition regulators share my concerns. In a November 2010 press release, the European Commission flagged “restrictions on the portability of online advertising campaign data” as its fourth concern in reviewing Google’s conduct, a concern most recently reiterated in December 2012 remarks by EC Competition Commissioner Joaquín Almunia. Last week’s statement by FTC Chairman Leibowitz is in accord: “Some Commissioners were concerned by the tendency of Google’s restrictions to raise the costs of small businesses to use the power of internet search advertising to grow their businesses.”

So everyone but Google agrees that the AdWords API restrictions are improper, and even Google has little to say in its defense. Indeed, despite abandoning most other aspects of its investigation, the FTC did pursue this matter. But the FTC reports only that Google is to remove AdWords API restrictions and that, the FTC indicates, ends the FTC’s concern on this subject. I am surprised by such a narrow remedy. The AdWords API restrictions have been in place for more than five years. Were it not for these restrictions, advertisers for five years would have enjoyed lower prices. For five years, third-party publishers would have received higher payment for their ad space. For five years, consumers would have seen more relevant ads at competing ad platforms, perhaps helping to increase competitors’ market shares and put a check on Google’s dominance. Moreover, for five years competing ad platforms would have enjoyed higher advertising revenues and higher ad click-through rates. It’s all well and good for Google to remove the API restriction going forward. But that does nothing at all to address past harm to advertisers and others.

What remedies would be appropriate for Google’s seven years of improper AdWords API restrictions? Let me offer three suggestions:

First, after years of improper conduct in this area, Google should expect to pay monetary damages. Google’s AdWords API restrictions inflated the prices charged to advertisers. Google should disgorge these ill-gotten gains via pro-rata refunds to advertisers.

Second, Google’s changes should be formal binding commitments formalized in a consent agreement. The 1969 Report of the American Bar Association Commission to Study the Federal Trade Commission recognized that voluntary commitments were ineffective, and the FTC largely discontinued voluntary commitments after that report. Indeed, FTC Commissioner Rosch last week noted that the FTC’s voluntary commitment approach lets Google offer a statement of its current intent, which Google could reverse or alter at any time. Moreover, an order would have required the FTC to take a clearer position on whether Google’s conduct violated the law: An order would have required the FTC to file a complaint, which in turn requires a finding by the FTC that there is reason to believe a violation has occurred. This formality would offer a useful confirmation of the FTC’s view — either the FTC believes a violation occurred, or it does not, but the voluntary commitment process lets the FTC avoid a public statement on this subject. Finally, orders are also vetted with third parties to make sure they will be effective. Microsoft’s Dave Heiner immediately offered several gaps in the FTC’s approach on AdWords API restrictions. I would have offered additional feedback had I been asked.

Finally, the FTC’s investigation surely found documents or records confirming the intent and effect of Google’s AdWords API restrictions. The FTC should at least describe those documents — if not release them in full. Describing or releasing these documents would let concerned parties determine what private claims they may have against Google. If the documents confirm meritorious claims, victims can pursue these claims through private litigation (here too, as Commissioner Rosch suggested).

Google’s AdWords API restrictions were a direct assault on competition — indefensible rules serving only to hinder advertisers’ efforts to efficiently use competing search engines, without any plausible pro-competitive justification. On this clear-cut issue, the FTC should have pursued every remedy permissible under its authority. Fortunately it’s not too late for state attorneys general and the European Commission to insist on more.

Disclosure: I serve as a consultant to various companies that compete with Google. But I write on my own — not at the suggestion or request of any client, without approval or payment from any client.

This week Google announced Google Search Plus Your World (“Google Search Plus” for short). Reaction has been critical. Danny Sullivan says Google Search Plus “pushes Google+ over relevancy,” and he offers compelling examples demonstrating this favored treatment. Meanwhile, EPIC executive director Marc Rotenberg argues that Google is “using its market dominance in a separate sector [search] … to fight off its challenger Facebook” — essentially, alleging that Google is tying Google+ to Google Search, forcing users to accept the former if they want the latter.

As Danny and Marc point out, Google is favoring its own ancillary services even when other destinations are objectively superior, and Google is using its dominance in search to compel users to accept Google’s other offerings. But this problem is much bigger than Google Search Plus: Google has used similar tying tactics to push dozens of its products for years. I’m working on a detailed article with numerous examples plus relevant antitrust analysis. But with Google Search Plus prompting so much interest, I wanted to flag other areas where Google has invoked these tactics.

This piece proceeds in three parts: I evaluate the competitive implications of Google favoring its own services, including the special benefits Google grants to its own services. I show how Google penalizes those who decline to participate in its tied offerings, including using tying to force others to submit to Google’s will even in areas where Google is not yet dominant. Finally, I briefly survey the legal implications and propose a promising but lightweight remedy to begin to curtail the harmful effects of Google’s tying.

My takeaway: Google’s tying tactics should not be permitted. Google’s dominant position in search requires that the company hold itself to a higher level of conduct, including avoiding tying its other products to its dominant search service. Google has repeatedly crossed the line, and antitrust enforcement action is required to put a stop to these practices.

The Competitive Implications of Favoring Google’s Own Services

I’ve found more than a dozen Google services receiving favored placement in Google search results. Consider Google Blog Search, Google Book Search, Google Checkout, Google Health, Google Images, Google Maps, Google News, Google Realtime, Google Shopping, and Google Video. Some have developed into solid products with loyal users. Others are far weaker. But each enjoys a level of favored placement in Google search results that other services can only dream of.

Google uses premium placements and traffic guarantees to address the “chicken and egg” problem that undermines the launch of many online businesses. For example, many retailers might be pleased to be listed (and even be willing to pay to be listed) in a review site or product search site that has many readers. But finding those readers cost-effectively requires algorithmic search traffic, which a new site cannot guarantee — hindering the site’s efforts to attract advertisers. So too for books, local search, movies, travel, and myriad other sectors. Ordinary sites struggle to overcome these challenges — for example, buying expensive pay-per-click advertising to drive traffic to their sites, or beginning with a period in which they have undesirably few participants. In contrast, anyone assessing the prospects of a new Google service knows that Google can grant its services ample free traffic, on demand and substantially guaranteed. Thus, the success of a new Google service is much more predictable — reducing Google’s barriers to expansion into new sectors. Indeed, if partners recognize that Google can send such traffic whenever it chooses to do so, they may even be willing to join before Google turns on the spigot.

Conversely, Google’s ability to favor its own service dulls the incentive for others to even try to compete. Who would risk capital, energy, and talent in building a new image search engine when Google presents Google Image Search results automatically? A new entrant might be 20% better, by whatever metric, but Google’s automatic provision of a “good enough” option dulls users’ interest in finding a best-of-breed alternative. The problem is particularly acute because the top-most result enjoys 34%+ of all clicks — so when Google takes that position for itself, there’s far less for everyone else.

Google also grants its ancillary services the benefit of certain placement. Ordinary sites have little assurance of what algorithmic search traffic they will receive. They may rank highly for some terms and worse for others. Furthermore, rankings often vary over time, including sudden changes for no apparent reason. As a result, most sites struggle to build business plans around algorithmic search traffic; indeed, companies have laid off staff after unexpected drops in algorithmic search traffic. In contrast, Google’s own services can feel confident in the traffic they will receive from Google — allowing them to plan budgets, advertising sales, hardware requirements, and overall strategy.

By all indications, free traffic from Google Search has played a valuable role in launching many Google businesses. For example, Google Maps usage remained sluggish until Google started to present inline Google Maps directly within Search Results, a practice that began in earnest in 2007. As Consumer Watchdog’s 2010 “Traffic Report” shows, this change precipitated a sharp increase in Google Maps’ market share: Traffic to Google Maps tripled while traffic to competing map sites fell by half.

So too for Google’s launch of Google Finance. service. For example, as of December 2006, Hitwise reported that fully 57% of traffic to Google Finance came from Google Search. By 2009, just 29% of Google Finance traffic came from other Google properties. By providing its ancillary services with additional traffic, when desired and in large quantities unavailable to others, Google gives its ancillary services a greater chance of achieving widespread usage and attracting users and advertisers.

The Special Benefits Google Reserves for Its Own Services

When Google presents its ancillary services within search results, it gives its services distinctive layout and format benefits unavailable to other sites. For example, Google Maps appears with an oversized full-color embedded map, whereas links to other map services appear only as plain hyperlinks. So too for links to Google Shopping, which often feature tabular reports of product pictures, vendors, and prices, whereas competing comparison shopping search engines receive only bare text. Until June 2011, Google Checkout advertisers enjoyed a special logo adjacent to their AdWords ads — particularly valuable since image advertisements were essentially nonexistent throughout that period. But advertisers who chose other streamlined checkout tools (like Paypal) got no such benefit. Favored treatment extends to the most obscure Google services. Even Google Health listings received a distinctive layout and colored image.

Furthermore, when Google favors its own ancillary services, it sometimes bypasses the algorithms that ordinarily allocate search results. By all indications, Google staff manually override algorithmic results, manually specifying that specific Google services are to appear in specific positions for specific keywords. Of course no other site enjoys such overrides.

Google also seems to exempt its own services from the “host crowding” rules that ordinarily assure source diversity. In 2007, Google’s Matt Cutts stated that a single page of results will feature “up to two results” from a single host, though he added that for a domain that “is really relevant” Google “may still return several results from that domain” (emphasis added). But it seems Google waives this rule for its own services. In April 2011, Aaron Wall flagged a search yielding five separate Google Books results among the ten links shown in the first page of Google Search. A commenter found another search term for which nine separate results all pointed to Google Books. (I have a screenshot on file.) On one view, Google Books indexes the work of multiple authors and publishers, and diversity among those authors and publishers provides adequate representation of alternative viewpoints. Yet other repositories also aggregate material from independent authors (consider books at Amazon, or any of thousands of online discussion forums), but only Google seems to enjoy an exception from “host crowding” rules.

Google Effectively Penalizes Those who Decline to Participate In Its Tied Offerings

I joined Google Plus not because I wanted to participate, not to take a look around, but because I perceived that Google would grant my site preferred placement — more algorithmic traffic — if I linked my Google Plus account to my web site and online publications. It’s hard to figure out whether I was right. But SEO forums are full of users who had the same idea. So Google can force users to join Google Plus to avoid receiving, or expecting to receive, lower algorithmic search ranking. Certainly myriad sites added Google +1 buttons (giving Google both data and real estate) not because they genuinely wanted Google buttons on their sites, but because they feared others would overtake them in search results if they failed to employ Google’s newest service.

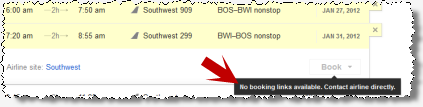

If an airline declines to participate in Google Flights, its listings are labeled “no booking links available.” Google fails to offer a more helpful link or booking shortcut, even though it could easily do so.

If an airline declines to participate in Google Flights, its listings are labeled “no booking links available.” Google fails to offer a more helpful link or booking shortcut, even though it could easily do so.

Google uses similar tying tactics to compel use of its other services. Consider airlines negotiating terms for appearance in Google Flight Search. If Southwest Airlines prefers not to be included in Expedia, it can easily stay out (and in fact it has). Better yet, a diligent airline can negotiate with various travel sites to seek improved terms — playing one travel site against another to reduce fees. But Google’s dominant position impedes any such negotiation. There’s only one Google Flight Search at the top of Google search results, and any airline that refuses Google’s terms is left behind: Google presents a “no booking links available” bubble, even though Google could easily send bookings to an airline web site without any commercial relationship with the site and without requiring payment from the site. (For an example, click to browse Southwest flights Boston-BWI in May — simple HTML and JavaScript, essentially a “deep link.”)

At the very least, Google could link to an airline’s home page in the bottom right, where the “Book” link usually appears; the bottom-right corner is the standard location for a button to continue a multi-step process, and that’s the location where Google has trained users to look to proceed with booking. In contrast, Google’s bottom-left links are easily overlooked. With so many better options available to Google, Google’s decision to withhold this link looks like intentional punishment for any airline that rejected Google’s terms.

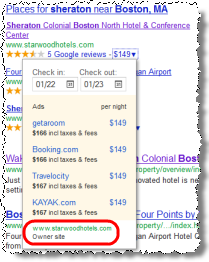

Google links to the “owner site” only at the far bottom of the drop-down — putting all advertisers in more prominent positions.

Google links to the “owner site” only at the far bottom of the drop-down — putting all advertisers in more prominent positions.

Meanwhile, by effectively compelling participation, Google enjoys high revenue from competing bidders. Consider the drop-down lists Google now shows with hotel listings, presenting advertisements for multiple booking services. A user can enter desired dates to receive a price quote from each booking service, with one-click access to the chosen vendor. But some users prefers to book with a hotel directly — perhaps to reduce booking complexity (less finger-pointing if something goes wrong) or enjoy loyalty program benefits. (Users may also know that hotels pay substantial commissions to the web sites that gather reservations, and some users may wish to spare hotels those costs.) If a consumer clicks the “owner site” link, the consumer will find that his booking dates are discarded, requiring reentry. And even though the “owner site” is the single most authoritative listing for a given property, Google puts all booking services above — here too, favoring advertising revenue over user convenience. It’s an experience savvy hotels would decline completely if Google offered that choice. Instead, Google makes this drop-down compulsory, and there’s no way a hotel can opt out.

To its credit, Twitter has recognized the value of the data it holds and has declined to let Google harvest that data on terms Google dictates. But when Twitter complained about Google’s favored treatment of Google Search Plus, Google responded: “We are a bit surprised by Twitter’s comments about Search plus Your World, because they chose not to renew their agreement with us last summer.” Google’s response completely misses the point. For one, as Danny Sullivan points out, Google fails to use Facebook and Twitter content it knows about (without needing a data license). Furthermore, Google equally fails to use content from thousands of other sources — from smaller social networks, for example. Instead, Google favors its own service.

Over and over, Google has tied its services in various combinations to compel (or attempt to compel) others to bend to its will.

I’ll have more examples in my forthcoming paper.

On one level, these are standard “all-or-nothing” tactics: Google has something others want, and Google only provides the desired service if it gets it way. But the impact is clear: Google’s multiple mutually-reinforcing tying arrangements extend Google’s position of dominance, forcing prospective business partners to bend to Google’s will, and enlarging Google’s control over ever more sectors.

When Google presents its ancillary services in its search results, it engages in classic “tying” behavior, raising concern under US and European antitrust law. Certainly Google’s search service is dominant, and US and EU investigations have already held as much — triggering the heightened duties of those with a dominant position.

Yet Google offers its search results only with its own ancillary services. In particular, Google gives no mechanism for users to obtain Google Search with others’ ancillary services or with no ancillary services at all. This tactic has already led Google to dominance in blog search, book search, image search, maps, news, and product search, and it is amply clear how this tactic could soon lead Google to dominance in reviews, local search, and travel search (satisfying the “dangerous probability” test in Verizon v. Trinko note 4). Is Google likely to succeed in social? It seems network effects offer somewhat greater protection to Facebook and Twitter than they do to review sites or travel search sites. But when Google uses the same tying strategy to claim a leg up in myriad sectors, it’s no great stretch to view the strategy with equal skepticism wherever it arises.

In Remedies for Search Bias, I offered several suggestions to blunt the worst of these practices. Most relevant: Google should let users swap its own services for competitors’ offerings. Consider users’ ability to choose their preferred web browser, media player, email program, and myriad other applications — choices that facilitates continued competition and innovation in all these areas. Yet a user at Google.com has zero ability to eschew Google Maps for Mapquest, or to replace Google Places reviews with Yelp. The first time a user runs a search calling for a review, Google could ask the user for his preferred review provider, and an unobtrusive drop-down box would let the user make changes later. Similar prompts would appear, as needed, for other key sectors — limited, of course, to areas where Google seeks to promote an offering of its own. I was thrilled when, in a little-noticed remark last summer, Danny Sullivan endorsed this approach (“hey eric: how about letting people choose their shopping, local, etc. one box provider?”). It’s an elegant and straightforward solution, sidestepping the most complicated questions of “regulating search” but putting an important check on Google’s abuse of its dominant position in search.

Edelman, Benjamin. “Antitrust Scrutiny of Google.” Journal of Law 2, no. 2 (2012): 445-464.

I evaluate antitrust claims against Google and propose possible remedies. While Google’s specific tactics are often novel, I show connections to practices deemed unlawful over a period of decades, and I identify remedies well grounded in antitrust precedent.

Last week Joshua Wright posted a critique of my January 2011 Measuring Bias in ‘Organic’ Web Search (with Ben Lockwood). Some quick thoughts –

First, there’s some important common ground here: Wright and I both find that Google shows many of its own results, and does so in prominent positions.

Now, Wright says Bing presents its own results slightly often more than Google does so. In contrast, important portions of my analysis indicated that own-service links are particularly prominent at Google. Why the gap between my analysis and Wright’s? One key challenge is the lack of a natural basis of comparison. Suppose Google controlled 50% market share while five competitors held 10% each. Then we could compare Google’s results to a possible consensus among the others — better revealing whether and when Google favors its own services. But in fact the runners-up are much smaller: after Bing+Yahoo, we reach smaller firms like Blekko, each with market share far below 1%. Without a competitive marketplace providing a baseline, comparisons between search engines are necessarily difficult. So it’s no surprise that the numbers come out differently depending on the approach.

Wright criticizes my decision to examine brief, popular searches rather than a selection of actual user searches. But searches are messy and idiosyncratic: Each day at Google, 20% to 25% of searches are completely new, never before seen. Wright favor analysis of searches seen in AOL logs, but this method tends to emphasize unusual searches like “dog who urinate on everything” and “you’re pregnant he doesn’t want the baby” (the first two examples in Paul Boutin’s 2006 examination of AOL logs). In contrast, I chose to focus on short, simple searches where biased results have a particularly broad effect.

Wright argues that if Bing presents its own results as often as Google does, then own-service links must be pro-competitive, raising no antitrust concern. I disagree. The same behavior can have very different consequences when performed by a dominant firm versus a smaller competitor. Indeed, section 2 of the Sherman Act only applies to companies with market power. Meanwhile, companies without market power may engage in the exact conduct that Section 2 prohibits. For example, Microsoft faced antitrust litigation when it included Internet Explorer in Windows, even as Apple permissibly included its Safari browser in MacOS.

Wright suggests that antitrust investigation of Google is stillborn for lack of consumer harm. I see two problems with this argument. First, competitive foreclosure is a sufficient cause for concern. Certainly Google’s own-service links can stymie competition: It’s a tall order to start the next Yelp if Google may adjust its algorithm to always put Google Places first. From 2006 through June 2011, ads from Google Checkout merchants featured a special logo — a benefit unavailable to merchants using competing checkout systems (like PayPal). Even the perception of such favoritism can disrupt competition: In June 2011 a Google Offers salesperson told a merchant that signing up with Offers would provide “SEO benefits” to make the merchant “number one in Google.” Google quickly disavowed that statement, but on Wright’s theory, this tactic would be entirely permissible. Imagine the harm to Groupon, LivingSocial, and fellow travelers if Google gave Offers advertisers the favored map placement that AdWords advertisers already enjoy. In my view, that’s the wrong result. New providers necessarily rely on Google to reach users, but their business plans won’t work if Google can systematically favor its own services at competitors’ expense.

Second, when Wright says there’s no consumer harm, he has the wrong consumers in mind. The folks paying the bills for Google are advertisers — and advertisers pay a high price that has only grown as Google gains market share.

Ultimately, Google’s antitrust problems go far beyond algorithmic search preference. Google’s harsh treatment of advertisers smacks of market power; an advertiser with a real choice of ad networks would not accept Google’s high prices and one-sided terms. Google’s dealings with mobile handset makers similarly draw on Google’s dominance: If there were numerous popular third-party operating systems for mobile handsets, Google wouldn’t be able to compel manufacturers into dropping third-party software like Skyhook; and if there were numerous strong vendors for search, maps, videos, and other core mobile apps, Google wouldn’t be able to bundle its mobile apps to compel handset manufacturers to take all of these as a condition of preinstalling any of them. At every turn, we see Google leveraging its dominance in certain sectors to shore up its position in others – and that’s a n approach that rightly raises significant antitrust concern.

This week Google ex-CEO Eric Schmidt will testify at a Senate Antitrust Subcommittee hearing that investigates persistent allegations of Google abusing its market power. Other witnesses include Jeff Katz, CEO of Nextag, and Jeremy Stoppelman, CEO of Yelp — ably representing the publishers whose sites are pushed lower in search listings as Google gives its own services preferred placement. But who will speak for advertisers’ interests?

Each year Google bills advertisers some $30+ billion; advertisers quite literally pay the bill for Google’s market dominance. Yet advertisers seeking search traffic have little alternative to the prices and terms Google demands. Consider some of Google’s particularly onerous terms:

Google tells advertisers nothing about others’ bids, and Google provides only ambiguous information about its assessments of advertisers’ ads. So advertisers are left to wonder “have I been penalized?” without rigorous methods to answer that question. Advertisers would flock to a viable alternative search engine that treated them fairly and predictably while offering high-volume search traffic. But Google’s market power makes any such switch unrealistic.

Even Google’s notification provisions are one-sided: An advertiser with a complaint to Google must sent it by “first class mail or air mail or overnight courier” with a copy by “confirmed facsimile.” (Despite my best efforts, I still don’t know how a “confirmed” facsimile differs from a regular fax.) Meanwhile, Google may send messages to an advertiser merely by “sending an email to the email address specified in [the advertiser’s] account” (clause 9).

These terms smack of market power: Rare is the advertiser who would accept such terms if reasonable choices were available.

Google has never offered any pro-competitive or competitively-neutral explanation for restricting how advertisers copy their own ad campaigns. In a rare moment of frankness, one Google executive once told me “we don’t have to make it easy” for advertisers to use competitors’ services. That argument might have passed muster a decade ago, but Google’s dominance puts such tactics in a new light.

Google likes to argue that “competition is one click away.” First, I question whether users can actually leave as easily as Google suggests: Popular web browsers Firefox and Chrome strongly favor Google, as Google CFO Patrick Pichette recently admitted (“everybody that uses Chrome is a guaranteed locked-in user for us”). In the mobile context, Android offers Google similar lock-in. And even on non-Google mobile platforms, Google serves fully 95% of searches thanks to defaults that systematically direct users to Google. Meanwhile, syndication contracts assure Google exclusive long-term placement on most top web sites. Against this backdrop, users are bound to flow to Google. Then advertisers must go where the users are. Whatever choice users have, advertisers end up with much less.

In the last ten years, Google grew from 12% to well over 80% worldwide. In that time, Google moved from zero ads to a dozen or more per page; from placing ads only on its own site to requiring advertisers to purchase ads with thousands of partners of dubious or unknown quality; from hustling to convince advertisers to buy its novel offering, to compelling advertisers to accept the industry’s most opaque pricing and most onerous terms. At the start of a new decade, Google is stronger than ever, enjoying unrivaled ability to make advertisers do as Google’s specifies. It’s time for advertisers — and the regulators who protect them — to put a check on Google’s exploitation of its market power.

Disclosure: I serve as a consultant to various companies that compete with Google. But I write on my own — not at the suggestion or request of any client, without approval or payment from any client.

In a forthcoming paper (update, November 2011: paper is available), I’ll survey the problem of search bias — search engines granting preferred placement and/or terms to their own links or to others’ links chosen for improper purposes. What purposes are improper? Given others’ work in that area, I’ll defer my thoughts on that subject to the paper. Today I’d like to focus on remedies — what tactics a dominant search engine ought not employ due to their detrimental effects on competition, and how prohibiting those tactics would help assure fair competition in search and related businesses.

The prospect of legal or regulatory oversight of search results has attracted skepticism. A search industry news site recently questioned the wisdom of investigating search bias by arguing that, even if bias were uncovered, “it’s not clear what any remedy would be.” James Grimmelmann last month critiqued the suggestion that search engines can be biased, and he argued that even if such bias exists, the legal system cannot usefully prevent it. Discomfort with the prospect of legal intervention extends even to those who ultimately see a need for oversight: For example, Pasquale and Bracha title a recent paper Federal Search Commission?, ending the title with a question mark to credit the immediate shortfalls of an overly bureaucratic approach. Meanwhile, Google’s caricature of regulation warns of government-mandated homogeneous results and unblockable web spam, offering a particularly pronounced view of search regulation as intrusive and undesirable.

I envision an alternative approach for policy intervention in this area — addressing the improprieties that various sites have alleged and stopping specific practices that ought not continue, while avoiding unnecessary restrictions on search engines’ activities.

Experience from Airline Reservation Systems: Avoiding Improper Ranking Factors

A first insight comes from recognizing that regulators have already — successfully! — addressed the problem of bias in information services. One key area of intervention was customer reservation systems (CRS’s), the computer networks that let travel agents see flight availability and pricing for various major airlines. Three decades ago, when CRS’s were largely owned by the various airlines, some airlines favored their own flights. For example, when a travel agent searched for flights through Apollo, a CRS then owned by United Airlines, United flights would come up first — even if other carriers offered lower prices or nonstop service. The Department of Justice intervened, culminating in rules prohibiting any CRS owned by an airline from ordering listings “us[ing] any factors directly or indirectly relating to carrier identity” (14 CFR 255.4). Certainly one could argue that these rules were an undue intrusion: A travel agent was always free to find a different CRS, and further additional searches could have uncovered alternative flights. Yet most travel agents hesitated to switch CRS’s, and extra searches would be both time-consuming and error-prone. Prohibiting biased listings was the better approach.

The same principle applies in the context of web search. On this theory, Google ought not rank results by any metric that distinctively favors Google. I credit that web search considers myriad web sites — far more than the number of airlines, flights, or fares. And I credit that web search considers more attributes of each web page — not just airfare price, transit time, and number of stops. But these differences only grant a search engine more room to innovate. These differences don’t change the underlying reasoning, so compelling in the CRS context, that a system provider must not design its rules to systematically put itself first.

I credit that some metrics might incidentally favor Google even as they are, on their face, neutral. But periodic oversight by a special master (or similar arbiter) could accept allegations of such metrics; both in the US and in Europe, a similar approach oversaw disputes as to what documentation Microsoft made available to those wishing to interoperate with Microsoft software.

Evaluating Manual Ranking Adjustments through Compulsory Disclosures

An alternative approach to avoiding improper ranking factors would require disclosure of all manual adjustments to search results. Whenever Google adjusts individual results, rather than selecting results through algorithmic rules of general applicability, the fact of that adjustment would be reported to a special master or similar authority, along with the affected site, duration, reason, and specific person authorizing the change. The special master would review these notifications and, where warranted, seek further information from relevant staff as well as from affected sites.

Why the concern at ad hoc ranking adjustments? Manual modifications are a particularly clear area for abuse — a natural way for Google to penalize a competitor or critic. Discourage such penalties by increasing their complexity and difficulty for Google, and Google’s use of such penalties would decrease.

I credit that Google would respond to the proposed disclosure requirement by reducing the frequency of manual adjustments. But that’s exactly the point: Results that do not flow from an algorithmic rule of general applicability are, by hypothesis, ad hoc. Where Google elects to use such methods, its market power demands outside review.

Grimmelmann argues that these ad hoc result adjustments are a “distraction.” But if Google’s manual adjustments ultimately prove to be nothing more than penalties to spammers, then regulators will naturally turn their attention elsewhere. Meanwhile, by forcing Google to impose penalties through general algorithms rather than quick manual adjustments, Google will face increased burdens in establishing such penalties — more code required and, crucially, greater likelihood of an email or meeting agenda revealing Google’s genuine intent.

Experience from Browser Choice: Swapping “Integrated” Components

Many complaints about search bias arise when longstanding innovative services are, or appear to be at risk of becoming, subsumed into Google’s own offerings. No ordinary algorithmic link to Mapquest can compete with an oversized multicolor miniature Google Maps display appearing inline within search results. (And, as Consumer Watchdog documented, Mapquest’s traffic dropped sharply when Google deployed inline maps.)

On one hand it is troubling to see established firms disappear in the face of a seemingly-insurmountable Google advantage. The concern is all the greater when Google’s advantage comes not from intrinsic product quality but from bundling and defaults. After all, if Google can use search to push users to its Maps product, Maps will gain market share even if competitors’ services are, on their merits, superior.

Yet it would be untenable to ask Google to disavow new businesses. It is hard to imagine a modern search engine without maps, news, or local search (among other functions largely absent from core search a decade ago). If legal intervention prevented Google from entering these fields, users might lose the useful functions that stem from integration between seemingly-disparate services.

What remedy could offer a fair chance of multiple surviving vendors (with attendant benefits to consumers), while still letting Google offer new vertical search services when it so chooses? E.C. antitrust litigation against Microsoft is squarely on point, requiring Microsoft to display a large choice screen that prompts users to pick a web browser. An initial listing presents the five market-leading options, while seven more are available if a user scrolls. But there is no default; a user must affirmatively choose one of the various options.

Taking the “browser choice” concept to search results, each vertical search service could, in principle, come from a different vendor. If a user prefers that her Google algorithmic search present embedded maps from Mapquest along with local search from Yelp and video search from Hulu, the user could configure browser preferences accordingly. Furthermore, a user could make such choices on a just-in-time basis. (A possible prompt: “We noticed you’re looking for a map, and there are five vendors to choose from. Please choose a logo below.”) Later, an unobtrusive drop-down could allow adjustments. The technical barriers are reasonable: External objects could be integrated through client-side JavaScript — just as so many sites already embed AdSense ads, YouTube player, and other widgets. Or Google and contributors might prefer server-to-server communications of the sort Google uses in its partnerships with AOL and with Yahoo Japan. Either way, technology need not stand in the way.

I credit that many users may be content with most Google services. For example, Google Maps enjoyed instant success through its early offering of draggable maps. But in some areas, Google’s offerings have little traction. Google’s Places service aspires to assess quality of restaurants and local businesses — but Yelp and Angie’s List draw on specialized algorithms, deeper data, and longstanding expertise. So too for TripAdvisor as to hotel reviews, and myriad other sites in their respective sectors. A user might well prefer to get information in these areas from the respective specialized services, not from Google, were the user able to make that choice.

Google often argues that competition is one click away. But here too, the E.C.’s Microsoft litigation is on point. Users had ample ability to install other browsers if they so chose, but that general capability was not enough when the standard operating system made one choice a default. Furthermore, at least Windows let other browsers truly immerse themselves in the operating system — as the default viewer for .HTML files, the default application for hyperlinks in email messages, and so forth. But there is currently no analogue on Google — no way for a user, even one who seeks this function, to combine Google algorithmic search with a competitor’s maps, local results, or other specialized search services.

Banning Other Bad Behaviors: Tying

Using its market power over search, Google sometimes pushes sites to adopt technologies or services Google chooses. Sometimes, Google’s favored implementations may be competitively neutral — simply technical standards Google wants sites to adopt (for example, presenting an index of pages to Google’s crawlers in a particular format). But in other instances, Google uses its power in search to promote adoption of Google’s own services.

I first flagged this tactic as to Google Affiliate Network (GAN), Google’s affiliate marketing service. GAN competes in one of the few areas of Internet advertising where Google is not dominant, and to date Google has struggled to gain traction in this area. However, Google offers remarkable benefits to advertisers who agree to use GAN: GAN advertisers alone enjoy images in their AdWords advertisements on Google.com; their advertisements always appear in the top-right corner above all other right-side advertisements (never further down the page); they receive preferred payment terms (paying only if a user makes a purchase, not merely if a user clicks; paying nothing if a user returns merchandise, a credit card is declined, or a server malfunctions). Moreover, merchants tend to use only a single affiliate network; coordinating multiple networks entails additional complexity and risks paying duplicate commissions on a single purchase. So if Google can convince advertisers to use GAN, advertisers may well abandon competing affiliate platforms.

Google’s tying strategy portends a future where Google can force advertisers and sites to use almost any service Google envisions. Google could condition a top AdWords position not just on a high bid and a relevant listing, but on an advertiser agreeing to use Google Offers or Google Checkout. (Indeed, Checkout advertisers who also used AdWords initially received dramatic discounts on the bundle, and to this day Checkout advertisers enjoy a dramatic multicolor logo adjacent to their AdWords advertisements, a benefit unavailable to any other class of advertiser.) Google would get a major leg up in mobilizing whatever new services it envisions, but Google’s advantage would come at the expense of genuine innovation and competition.

Edelman, Benjamin. “Bias in Search Results?: Diagnosis and Response.” Indian Journal of Law and Technology 7 (2011): 16-32.

I explore allegations of search engine bias, including understanding a search engine’s incentives to bias results, identifying possible forms of bias, and evaluating methods of verifying whether bias in fact occurs. I then consider possible legal and policy responses, and I assess search engines’ likely defenses. I conclude that regulatory intervention is justified in light of the importance of search engines in referring users to all manner of other sites, and in light of striking market concentration among search engines.